Global, Domestic PE Majors, AMCs Show Interest in GTL

Selling 51% Stake GTL Infra promoter Manoj Tirodkar looking to exit the co by fiscal end

PE Funds, AMCs Keen to Buy 51% in GTL infra

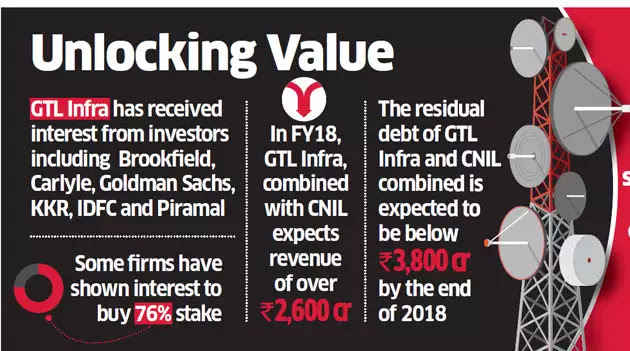

GTL Infra has received interest from global players like Brookfield, Carlyle, Goldman Sachs and KKR, besides local ones like IDFC and Piramal, for selling over 51% stake by March next year.

“We remain committed to completing the divestment process as a matter of our very strong desire to unlock value and repay the entire debt and equity upside tour lenders,” said Manoj Tirodkar, chairman at GTL Infra.

Having been hit hard by the 3G licence cancellations, Aircel backing out of tenancy commitments and slower-than-expected rollout of 3G and 4G services, GTL Infra has managed to gradually turn around its operations, helped by first a debt restructuring in 2011, when lenders took a haircut, and the ongoing strategic debt restructuring (SDR), which is expected to culminate in new owners taking over the company.

GTL Infra is in the process of restructuring its bonds, which are due for redemption in November

After the merger of CNIL and GTL Infra and restructuring of bonds, Global Group is expected to have around 27% holding and 23 banks will have 51% with public and bond holders owning the rest.

As per SDR guidelines, lenders must get an exit of minimum 26%. Between FY11 and FY17, the company has paid ₹5,900 crore and given equity worth over ₹7,400 crore to banks. “The company is endeavouring to complete the sale process before the regulatory timeline of March 18,” said GTL Infra in a statement to BSE on Friday.

Last year in September, the tower firm saddled with a debt of ₹8,662 crore started its SDR programme, which has brought it down to ₹4,193 crore. “Residual debt of GTL Infrastructure and CNIL combined is expected to be below ₹3,800 crore by end 2018. We are also in the process of refinancing debt, to further reduce finance costs,” said the person quoted above.The company is in the process of restructuring its bonds, which are due for redemption in November. After the restructuring, the “unsecured debt will reduce from the current levels of ₹1,441 crore ($193.5 milion) in March 2017 to around ₹655 crore ($100 million),” a move which has been approved by its lenders.

He added that GTL Group companies will end up settling all their debt with lenders and will have zero exposure across the group when a transaction involving 51% sale takes place by March 2018. Total debt of the group as of March this year was ₹5,571 crore. The company has appointed EY and TAP Advisors as investment bankers for the stake sale.

The deal, when it goes through, will be another consolidation in the telecom tower industry, after the ATC-Viom and Brookfield-Reliance Infratel deals. Other deals in the market include potential sale of Vodafone and Idea Cellular’s standalone towers, besides their stakes in market leader Indus Towers.